This article outlines and details the 10 best ECN brokers in Malaysia. Not only are retail traders and professional, institutional traders looking for brokers that offer good ECN accounts, but they should be looking for brokers that offer and include all features that a trader is looking for.

ECN accounts should have tight spreads and low commission fees, and the broker should have this and more. Let’s see who is the best ECN broker in Malaysia.

Top ECN Broker Malaysia 2023

Trading is a multifaceted environment that can be complex but rewarding, and knowing how to trade and on what type of account to trade on is critical. Many online brokers promote their services and features in terms of tradable assets, trading CFDs, stocks, and so on.

However, traders that are looking for that edge on the markets wanting to make lightning-fast (and even instant) executions are looking for brokers (especially forex brokers) with ECN accounts.

ECN accounts offer benefits that other trading and standard forex accounts don’t offer. We mentioned lightning-fast execution, but you can also expect the tightest spreads and, in some cases, no spreads. There are quite a number of factors to consider when looking at ECN accounts and ECN brokers, but luckily, once again, we have done all the “heavy lifting” for you.

This review covers what we regard as the best ECN brokers you will find in Malaysia, and we have looked at the features of their ECN accounts and what other benefits, services, and features these brokers have. This ECN broker review covers all aspects of brokers, from regulations to customer service, educational material, deposit and withdrawal methods, reputation, and more.

Having all this information available to you in this review should clearly indicate which broker is best not only for ECN accounts but as a whole. You will only need to decide which is best suited for you, your trading, and your situation, and we have ranked them from best to “not so great.”.

Here is the list of the best ECN brokers available in Malaysia:

- ZFX

- Exness

- FBS

- FP Markets

- RoboForex

- Axi

- JustMarkets

- Tickmill

- ICM Capital

- AximTrade

ECN Broker Comparison Malaysia

| Broker | Overall Rating | Accepts MY Residents | Official Site | Min Deposit | Max Forex Leverage | Beginner Friendly | Regulators |

| ZFX | 9.2/10 Review | Yes | Account Creation | 50 USD | 2000:1 | Exceptional | FCA, FSA |

| Exness | 7.5/10 Review | Yes | Account Creation | Depends On the Payment System | Unlimited | Quite Good | CySEC, FSA, FSCA, FCA, FSC, CBCS |

| FBS | 7/10 Review | Yes | Account Creation | 1 USD | 3000:1 | Quite Good | ASIC, CySEC, FSCA, IFSC |

| FP Markets | 6.6/10 Review | Yes | Account Creation | 100 AUD or Equivalent | 500:1 | Not Bad | ASIC, CySEC, FSCA |

| RoboForex | 6.6/10 Review | Yes | Account Creation | 10 USD | 2000:1 | Fairly Good | FSC |

| Axi.com | 6.6/10 Review | Yes | Account Creation | 0 USD | 500:1 | Not Bad | ASIC, FCA, DFSA |

| JustMarkets | 6.4/10 Review | Yes | Account Creation | 5 USD but varies on the method used | 3000:1 | Not Bad | VFSX, CySEC, FSCA |

| Tickmill | 6.1/10 Review | Yes | Account Creation | 100 USD or equivalent | 500:1 | Fairly Good | ASIC, CySEC, FSA, FSCA, FCA |

| ICM Capital | 5.8/10 Review | Yes | Account Creation | 200 USD | 200:1 | Average | FSA, FCA, FSC, ARIF, QFC |

| AximTrade | 4.8/10 Review | Yes | Account Creation | 1 USD for Standard Account | 3000:1 | Average | ASIC, FSA |

Best ECN Trading Platform in Malaysia (Reviewed)

1. ZFX

ZFX is our top pick for the best ECN as well as the best STP broker that we have come across. Founded in 2016, ZFX has firmly established itself as an online broker market leader. We consider ZFX the best choice for retail traders and professionals.

First and foremost, ZFX is regulated by two top-tier financial authorities, namely the FCA and FSA. In conjunction with their fantastic customer support via multiple channels, clients have had nothing to say but praise regarding this broker.

Clients can expect to use the “gold standard” in terms of trading software with ZFX, and that is MetaTrader4. Since 2005 MetaTrader4 has dominated the market and solidified itself as the “go-to” trading software of most of the top-tier brokers.

Other brokers may have proprietary software, but in doing so, questions are asked about its reliability, stability, and transparency. MetaTrader is the most stable and safe platform with all the functions and features a trader needs.

Then ZFX is a No Dealing Desk (NDD) broker. They connect clients to banks, interbank markets, and liquidity providers. ZFX further subdivides NDD into Straight Through Processing (STP) and Electronic Communication Networks (ECN) accounts, depending on the many varied needs of the client.

NDD brokers are typically considered more transparent than Dealing Desk brokers regarding transactions. In addition to transparent transactions and due to STP and ECN, the trader’s identity will not be exposed, with orders being executed immediately and anonymously. With clear transparency and top-tier regulators, ZFX has undoubtedly made waves and made a name for itself as the best ECN (and STP) broker.

ZFX also has many other services and features that we can go on all day about, like their negative balance protection policy, the great amount of trading resources in the A-Z academy, Market News, and Market Insights. They also hold numerous awards, and we will not forget to mention that this broker often holds trading competitions (giving out amazing prizes) and is implementing a new LMS so traders can improve their skills. Lastly (because we can’t dedicate this whole article to them), they are also trying to implement an Interest Program whereby clients earn up to 9% annual interest. Just for reference, banks typically offer 4%.

Pros

- STP and ECN broker

- Tighter spreads on ECN accounts (from 0.2 pips)

- Low initial deposit ($50) with a minimum lot size of 0.1

- $15 Minimum Deposit (Cent Account)

- Three to Two types of trading accounts depending on the region

- 100+ assets to trade

- Zero commission with low spreads

- Regulated by the FCA and the FSA

- Great resources for traders (A – Z Trading Academy)

Cons

- Trading is not available to U.S.-based residents

- No Web-Based Platform

2. Exness

In this ECN broker review, Exness makes it to 2nd place as the best ECN broker in Malaysia. We have covered this broker in a couple of other reviews regarding “best forex brokers in Malaysia,” and they ranked as just above average. However, in terms of ECN accounts, and forex trading, this broker ranks quite high.

Founded in 2008 and managed by Nymstar, this broker is regulated by multiple authorities, which is always good. As with ZFX, they have a multitude of trading resources and education and offer MetaTrader as their preferred trading software along with a mobile app (as does ZFX).

Exness offers what you would expect to find in terms of their accounts and online trading, but it may be a bit confusing for clients who do not have much experience with forex trading or ECN forex brokers. This is because their account types are worded for individuals who know what they are looking for.

Some of the downfalls of this broker include having a 500 USD minimum deposit for some trading accounts and not having multiple channels to contact support. In the case of Exness, clients can only rely on Email and telephonic support, unlike ZFX, which has a live chat directly accessible from its website.

We recommend this broker to traders with experience, whereas ZFX is great for beginners and seasoned professionals.

Pros

- Multiple trading platforms: MT4, MT5, MultiTerminal, mobile platform

- Free VPS hosting

- High Maximum Leverage

- Narrow spreads

- Instant withdrawal of money 24/7 depending on the method used

- Segregated accounts

Cons

- Training resources are not that great

- No US residents can be accepted to trade

- 24/7 customer support only available in some languages

3. FBS

We rank FBS as an ECN forex broker that is at the same level as Exness. The only reason that they do not get a higher score is due to some lacking services and features that we think are key and that the best ECN brokers in Malaysia (and across the globe) should have.

Although this broker has received numerous awards and is regulated by many financial authorities, they fall drastically short regarding the number of tradeable instruments they offer their clients. Keep In mind that this broker was established almost a decade prior to ZFX, and their assets list pretty much mimics that of ZFX for the most part.

However, FBS (as with Exness) has an array of trading resources. Although not specific to material pertaining to ECN or STP brokers, you will be able to find everything from a blog to webinars and video tutorial lessons on this broker’s website.

FBS also uses MetaTraers as its preferred trading software, and this is one aspect of this broker that raises its score as they also offer MetaTrader5. For most, many brokers only incorporate MT5 when stock trading is a key part of their online trading.

As with this trader (along with ZFX and Exness), you can expect to find good customer support and many methods for depositing funds. FBS also offers spread betting and operates in specific regions, so we suggest doing some research on this broker before you decide to open an account.

Pros

- Free social trading app (FBS CopyTrade) for traders to improve their performance and knowledge by copying other investors (for regions under IFCA and FSCA regulations only)

- Exemplary, multilingual customer service is always available

- Low spreads and commissions (from 0 pips) on most accounts

- Free demo account for every account type helps clients to do a trial

- No withdrawal fees

- Strong research and education resources

- High leverage up to 1:3000 (for non-EU customers only) suits higher-risk traders well

Cons

- ECN Account can be confusing

- Some instruments have wide spreads

- Limited number of commodities to trade

- EU, UK, and Australian clients have fewer account options than clients from other regions

- It lacks proprietary web and desktop platforms

4. FP Markets

In operation since 2005, FP Markets is one of the oldest brokers on our list and has almost two decades of experience as a reputable online ECN and STP broker. Once again, expect to find the typical array of tradeable assets with this broker, along with MT4 and MT5. Remember that trading software plays a crucial role in any online broker’s “portfolio” as it is the core of how clients interact and trade. As such, brokers and especially ECN brokers, forex trading accounts need to have instant execution, and MetaTrader is the platform that delivers this and has been since its release in 2005.

FP Markets has a few other great characteristics, one being their sterling customer reviews that you can find on Trustpilot, along with them being regulated by multiple authorities. They have a large assets list and multiple ways to deposit and withdraw.

Then when looking at their trading resources and educational material, you will find everything from video courses to webinars. Although this broker has most of what a trader is looking for, they do not excel in any one area, and as such, we find that they “spread themselves too thin.”.

However, if you are a trader who knows what they want and is looking to trade specific forex pairs along with specific ECN broker spreads, then FP Markets might just be for you.

- Over 10,000 assets to trade

- Good amount of trading resources

- Islamic Swap Free accounts are an option

- Many funding methods are available

- MT4 and MT5 are available

- Been in business since 2005

- Regulated by multiple financial authorities

- Two easy-to-understand account types

Cons

- Some information and trading resources on the site are outdated

- There is no Cent account available

- There are no special offers except for the affiliate and IB program

- Only trade CFDs

- There is a minimum deposit of 100 AUD or the equivalent

5. RoboForex

RoboForex is a popular and well-known broker with over 1 million clients that span 169 countries globally. Although this broker is quite popular, some caution should be advised as they are only regulated by one financial authority. The authority is the Financial Services Commission (FSC), and although they are rated as a top-tier authority, a broker with this amount of “clout” should, in fact, be regulated by more.

Regarding trading software, RoboForex offers MT4 and MT5 along with some proprietary software; however, this software is mainly geared toward beginner traders and should not be considered if you need MetaTrader’s powerful features to offer.

The aspects bringing this broker down are not its ECN accounts but its lack of educational and trading resources. For a broker of this scale, this should be a major factor that plays in role in client acquisition. RoboForex, in terms of trading resources, has what we would regard as the bare minimum. You can find a handful of trading tips, a blog, and an analysis section, and that’s all.

On the “upside,” this broker offers good ECN accounts and multiple customer service channels. These include Telegram, WhatsApp, and even Facebook Messenger, along with the usual channels such as Email and live chat. This does “raise the bar” of this broker a certain amount.

Pros

- No deposit or withdrawal fees

- MetaTrader (4 and 5) are available

- They have proprietary trading software

- More than 12,000 instruments to trade

- Lack of trading resources and education

- Have a few promotions and special offers

- In operation for over a decade now

- Accumulated over 30 industry awards

- Can trade CFDs for forex, stocks, crypto, commodities, and indices

- Can also trade in shares

- There are 5 trading account types

- Low spreads on some accounts

- Cent account is available

Cons

- Low customer trust rating

- Too many account types

- Only regulated by the FSC

- Not many trading resources or education

6. Axi

Axi is a broker that is quite well-known but does not quite make the cut for many of our reviews. If you do not know, this broker has been in operation since 2007, making it another broker that has been in operation for almost two decades. Multiple authorities regulate them (ASIC, FCA, and DFSA), and they also hold many awards that span over the years. This increases their reputation, but this broker is not “beginner friendly” per se.

They offer multiple account types, and although they are an ECN and STP broker, we suggest that clients with trading experience look at this broker, as things do get a bit confusing if you do not know what you are looking for.

Again this broker offers MetaTrader as their trading platform, and the amount of trading resources is quite impressive. From an Academy (like ZFX) to blogs, downloadable eBooks, and more, Axi does try to cater to traders of all levels.

Their customer support is quite comprehensive, with multiple international telephonic support lines and Email and WhatsApp. However, deposit and withdrawal methods are limited to only the most popular methods and have no trading competitions or giveaways. Rather they have the “typical” IB and affiliate programs that most brokers (including ZFX have).

Pros

- Deposit insurance and compensation plans are available

- Very low forex fees

- No withdrawal or deposit fees

- A typical range of tradable instruments on offer

- Creating an account is fully digital

- Regulated by three authorities

Cons

- Users have experienced problems withdrawing funds

- The account verification is complicated and drawn out

- Demo account is only available for 30 days

7. JustMarkets

JustMarkets is an average broker when considering many factors but it is on our ECN broker list because of the ECN accounts that they offer. This broker (as with ZFX) has multiple account types and also uses VPS hosting. In simple terms, VPS is a service that allows you to lease a virtual personal computer for trading.

Brokers such as JustMarkets that utilize VPS hosting offer lightning-fast automated trading, which runs through the hosting of virtual servers. These virtual machines run independently from your own and thus provide the opportunity to trade 24/5 without any mishaps or interruptions.

This is why JustMarkets (even though ranking as an average broker) is still a great ECN broker, and we consider them to be one of the best ECN brokers in Malaysia.

The broker is also trustworthy, being regulated by three financial authorities around the world, and they also have a negative balance policy like all other brokers on this list. In terms of methods for deposits and withdrawals, they are on the same “level” as Axi, offering only the most popular.

However, trading resources are robust; you can expect forex articles, educational videos, daily forecasts, and more. Then, customer support is quite good as they offer multiple ways to get in touch, including that of using social media. They also have separate support channels for compliance, partners, and clients.

Although this broker is quite good, they deal mainly in forex, and if you are not specifically looking for a broker with VPS hosting, then they might not be for you.

Pros

- No commission or hidden fees

- MT4 and MT5

- VPS Hosting

- Low spreads

- High leverage (1:3000)

- Over 170 trading assets

- Comprehensive customer support

- Sterling customer reviews

- Lots of deposit and withdrawal methods

Cons

- No US, EU, and Canadian clients allowed

- Only deal in forex and crypto

8. Tickmill

Tickmill is a broker we consider average at almost everything they do. From fees to customer support, ECN accounts, other account types, and methods for deposits and withdrawals, this broker does not excel at any, but it is not bad either.

Providing brokerage services since 2015, they are just as old as ZFX about. MetaTrader 4 and 5 are on offer for clients along with a mobile app, but the app is only for account management and not for trading. As we said, this broker almost hits the mark for most aspects that would make them great but just miss it.

There are three account types on offer, with one being an ECN account, but the balance for that account is 50,000 USD minimum. Deposits and withdrawals are similar to Axi and JustMarkets, and their customer support only lets clients get in touch via Email and live chat. Although we consider live chat to be a great customer support service, it should not be one of the only ways to get in touch with a broker.

Their trading resources and educational material “save” them to a degree as they offer webinars, seminars, video tutorials, and more. However, the content within all these sections is limited, and some are even outdated.

If you are looking for a broker who “kind of” does everything right and you are not really worried about much, then this broker is fine.

Pros

- Regulated by multiple authorities

- Has MetaTrader4 and MT5

- Three “basic” trading accounts

- Able to trade CFDs

- No commissions

- Good customer support

- Good trading resources

- Good trading education

Cons

- Mobile app is only for account management

- Commission on two of the three trading accounts

- Can’t trade commodities

- The minimum deposit is 100 USD, regardless

- No mobile trading app

9. ICM Capital

ICM Capital is an international online ECN and STP broker that lets clients trade forex, precious metals, US stocks, futures, crypto, and securities. They have been another broker in operation since the late 2000s, as they were founded in 2009. They do have numerous awards that date back to 2011, but this is another broker that just “misses the mark” when it comes to everything besides ECN accounts.

In the case of ICM Capital, they are regulated by several authorities, including the FCA and FSC, but they have no online presence in terms of customer reviews, so deciding whether this broker is a good fit for you based on that is out of the question.

They do offer MT4 and MT5 but no mobile app. Also, the number of account types is limited to two, with one being an ECN account. However, the minimum deposit for that ECN account is 200 USD, and leverage is limited to 200:1.

Their trading resources, educational material, and methods for depositing and withdrawals are also average in that this broker covers the bare minimum (again, like some of the other brokers on this list). However, they offer something unusual regarding special promotions, and that is a MasterCard. You can, in fact, apply for a Master Card from this broker, but not including a 10% credit bonus; that is where the special promotions end.

If you are looking for a broker that offers a limited ECN account but would like to get a credit card, they may be for you.

Pros

- Regulated by seven authorities

- Futures and securities trading

- Nice range of forex pairs

- Easy to open an account

- Good customer and technical support

- Regular promotional offers

- Obtained several awards

Cons

- Only two account types

- Maximum leverage is 1:200;

- The minimum deposit is USD 200 or an equivalent amount

- Trading resources and educational material is limited

10. AximTrade

Aximtrade is the last broker on our list, and we would like to point out that although they are last and that some other brokers do not rate as high as ZFX, these are still top-tier brokers, and we regard them as the best ECN brokers in Malaysia. We suggest that you review all brokers before making your decision, as one might suit your situation better, even if you are only looking for an ECN or STP broker.

Although AximTrade sponsor the Alfa Romeo F1 team, have over 100 thousand clients and has been in operation for about 5 years, there is still much this broker can do to improve. In terms of their assets, they offer the minimum that any broker should offer while they have multiple trading accounts and accounts with infinite leverage. Remember that all trading carries risk, and if you do not understand margin and leverage, you are bound to lose the money in your account.

However, this broker offers negative balance protection, which is good, especially when dealing with “infinite” leverage. In terms of trading resources, this broker offers nothing except an economic calendar, which says a lot. Instead of trying to promote an F1 team, this broker should spend more time providing resources and material that would benefit their clients.

Then the support channels for this broker include Email, live chat, and a contact form. This is pretty good, but as we said, it is not enough for a broker to rank higher on this list. If you have no other options in terms of a broker who suits you that has an ECN account; then we would suggest AximTrade.

Pros

- Flexible high leverage

- Regulated by multiple authorities (ASIC and FSA)

- 1 USD minimum deposit on most accounts

- ECN account

- MT4 is standard

- Over 49 forex pairs to trade

- AximTrade mobile app

- Multiple payment gateways

- Registration is easy

Cons

- High leverage means high risk

- Their assets list is limited

- Only MT4 is available

- Spreads are average except for the ECN account

- Not available in many countries

How To Start ECN Trading in Malaysia?

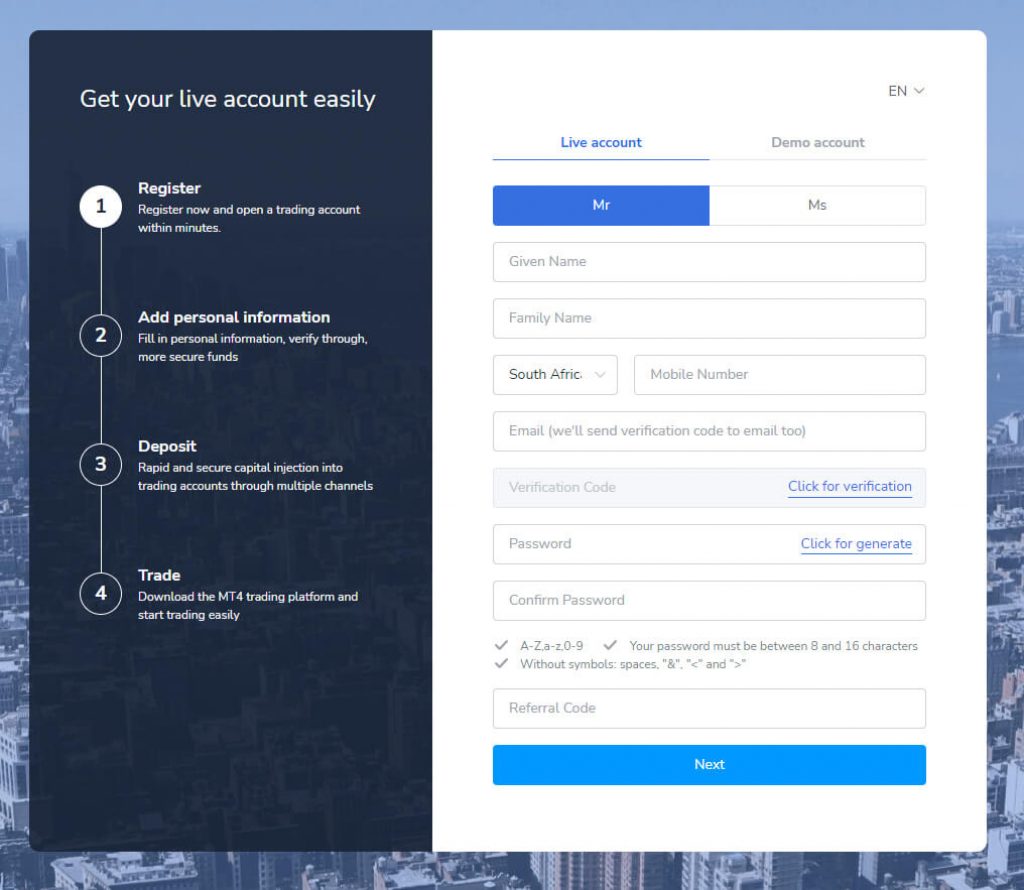

In this section, we are going to run you through how to open up an ECN account with a broker. In this case, we are going to be using ZFX as the broker to sign up with, and if you would like to sign up with ZFX, then visit this link.

Remember that opening an ECN account should be the same process as opening up a standard account. The difference will come when you must select your account types at registration.

For brokers who have a “quick” registration process and do not let you choose an ECN account specifically at registration, the option should be available in the client dashboard. If not, then you would only need to speak to support to get an understanding of how to do it.

Open an Account

To register with an online broker, you will need to head to their main website. Take note that depending on your region, the layout for the main site of the broker may change, but typically, the registration button is located in a fairly “easy to see” place like the main menu.

In terms of ZFX, when you visit their main site, you will not need to worry about this, as all layouts have been consolidated to look the same. To start the registration process, click on the “open account” button, which can be found in the top header of the website.

You will then be taken to the registration page. Here you will have to fill in some personal details and other information, such as;

- Title

- Last name

- Country

- Phone number

- Password

Here you will also choose whether or not to open a “live” or a “demo” account with ZFX.

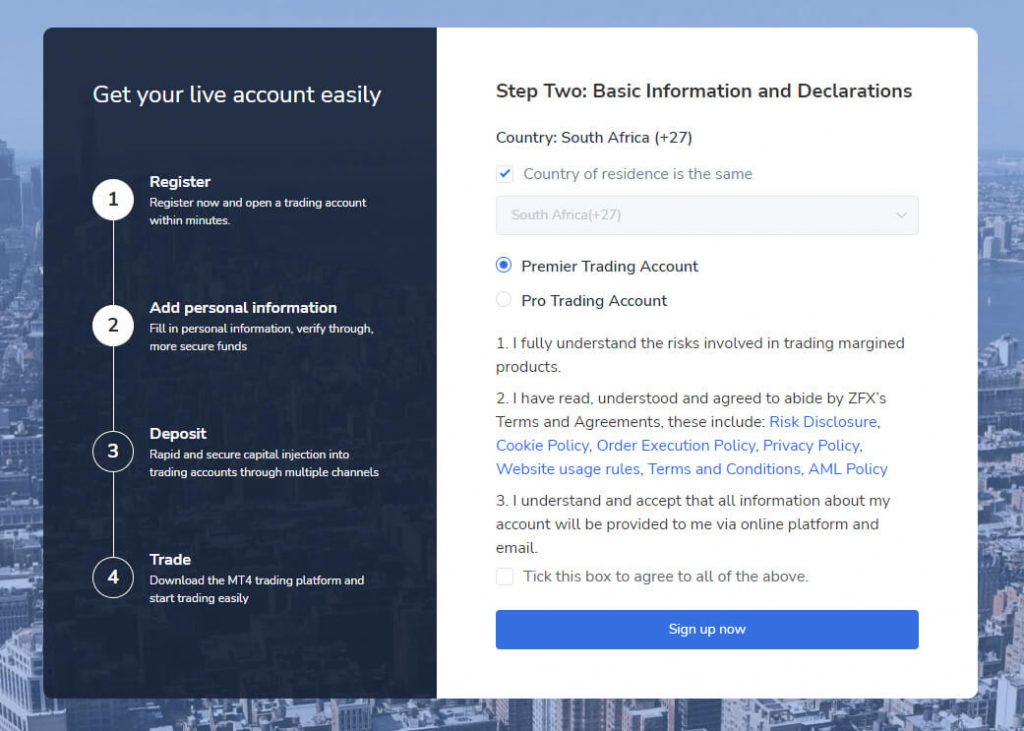

After filling in all the necessary information, ZFX will send an OTP to the cell number you have input, and you will need to fill this in to proceed with the registration process. Doing this will take you to the next page, where you will choose your account type. It will help to remember that we are signing up for a live ECN account, so this tutorial covers that.

Take note that on this page, you will select to open your ECN account type, but because we are in a different region, we can only open a Pro or Premier account. In this case, the Pro account is the ZFX ECN account for regions outside Malaysia. For residents situated in Malaysia, your options will be ECN, Cent, and STP.

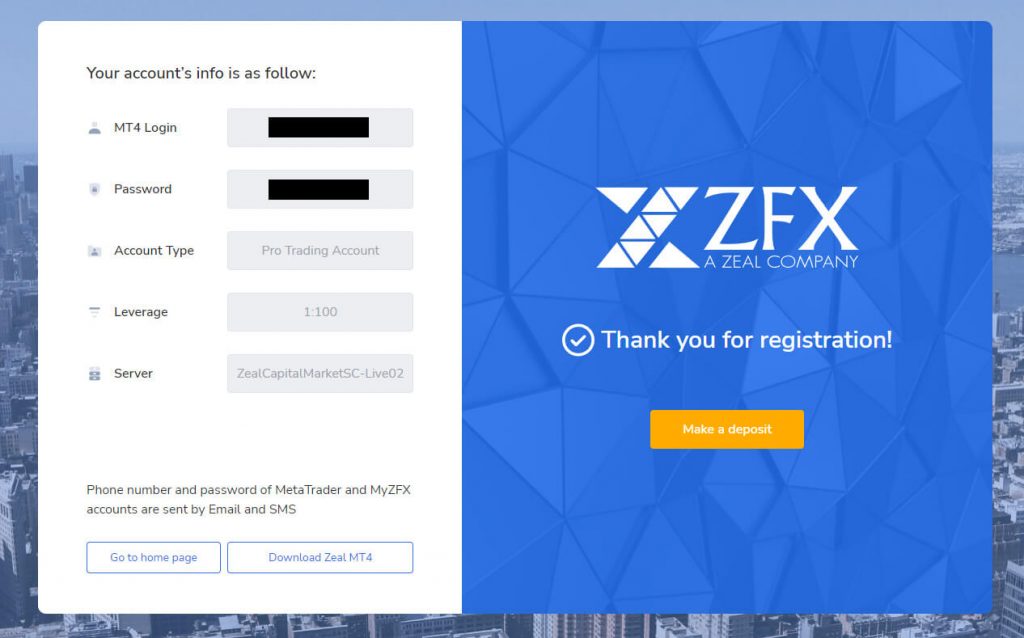

The next page will prompt you with options to download MT4 and give you information on your account details, including your account password. Remember that here your account password is used for logging in to the MyZFX client dashboard.

Make your First Deposit

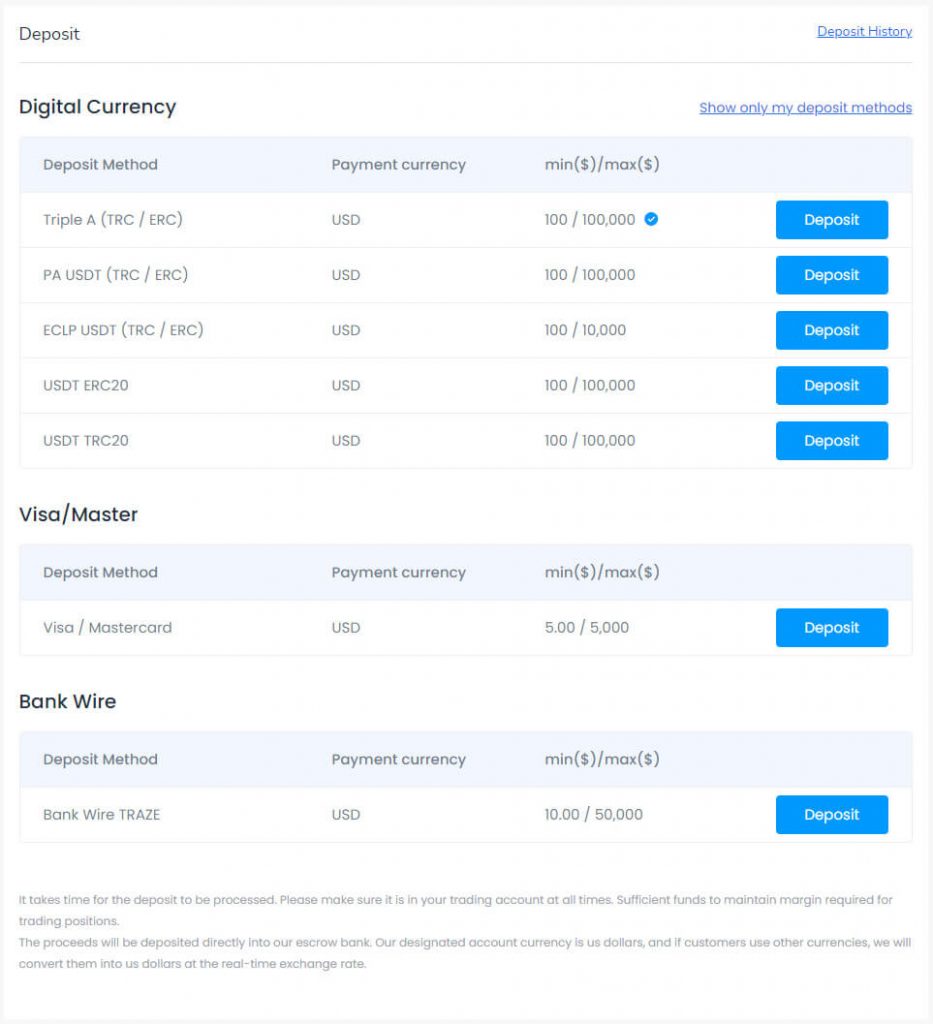

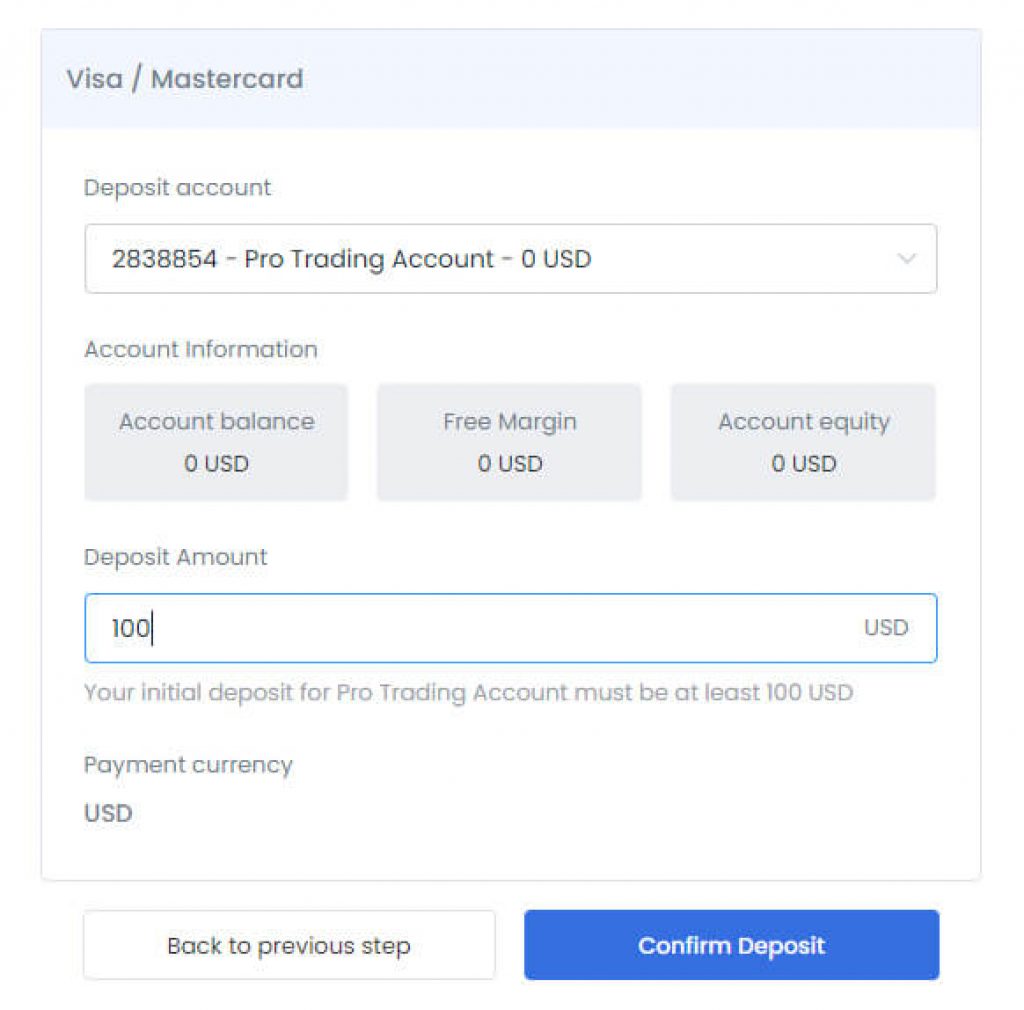

Opening a live ECN account means you will need to fund your account with at least 1,000 USD. Once you have logged into the client area, you will have to head to the “make a deposit” section, which will prompt you with various methods that can be used for depositing funds.

Remember to fill in all the necessary information (choose) and ensure that you understand that different depositing methods require a minimum amount. However, for your ECN account, you will need to deposit 1,000 USD to activate it. Confirm your deposit and proceed to the payment gateway, where you can complete your transaction.

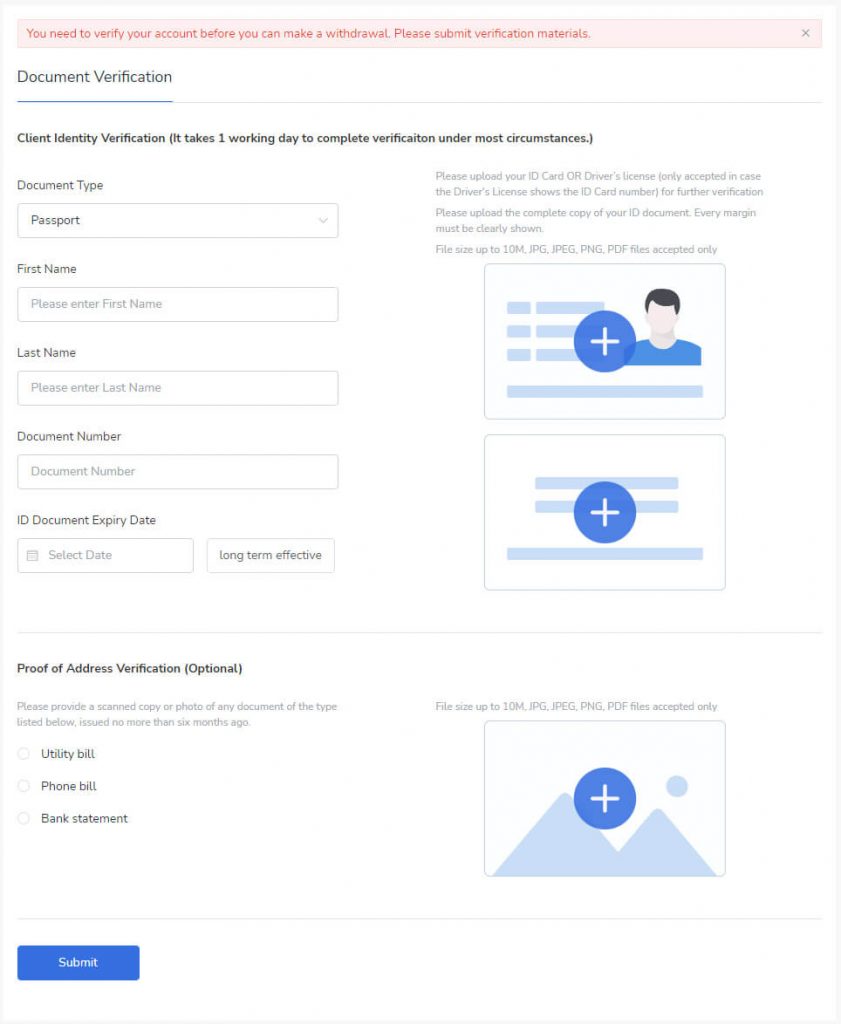

Verify your account

Remember that if you would like to apply for the up-and-coming Interest Program as well as withdraw funds from your account, you will need to verify your identity with ZFX. It will help to understand that you should complete the KYC requirements of this broker before you even deposit.

Remember that for identity verification, you will need numerous documents, including ID, bank statements, and proof of residency. Look at the image below for a clearer idea.

Start Trading

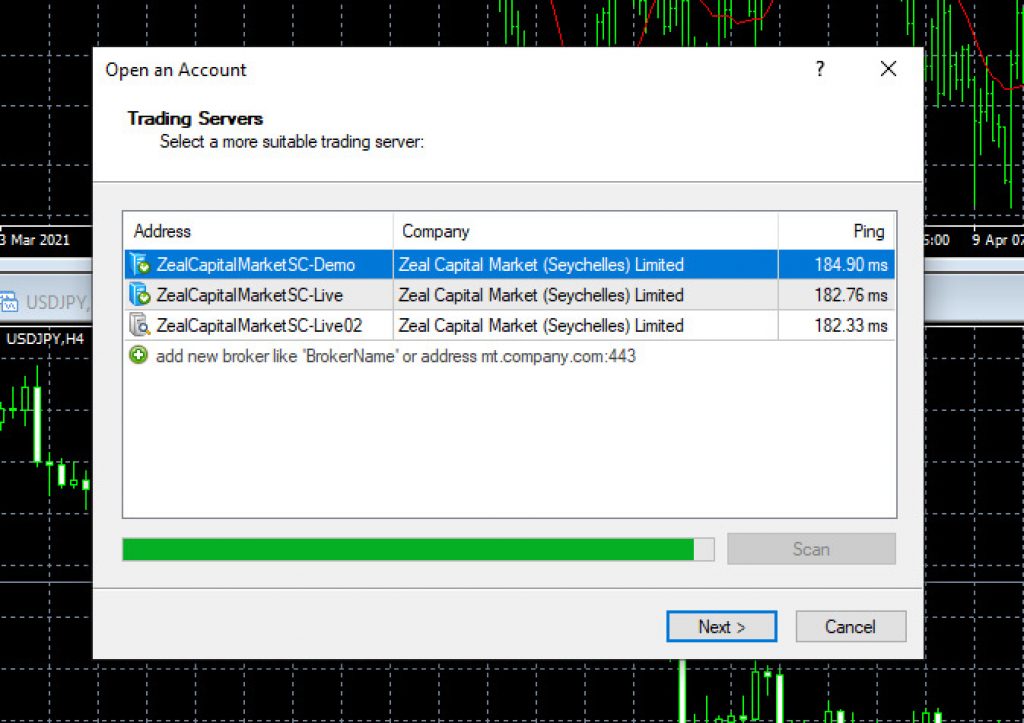

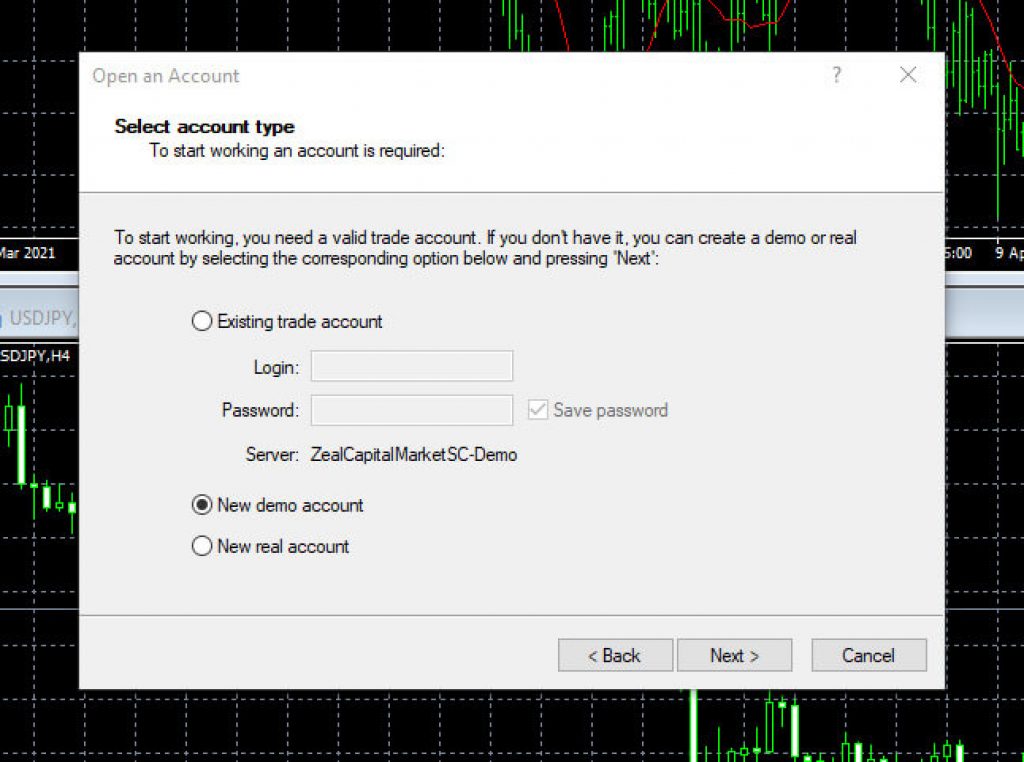

To start trading, you will need to open up MT4, meaning you would have had to already downloaded and installed it. Once you have opened MT4, you will be given server information and need to select the correct one. Remember this information would have been given to you in the signup process.

After this is done, you will select your account. Here you will choose “live” or “demo” and fill in your details, and for the purpose of this tutorial, you will need to select “live” because you have opened an ECN account. MT4 will then connect to the ZFX servers, and you will have access to your funds and the markets.

Advantages and Disadvantages of ECN Trading in Malaysia?

Advantages

- facilitate transactions that occur on electronic communication networks

- Trading with a true ECN broker gives you more anonymity than other brokers

- ECN accounts typically have higher bids, and lower ask prices

- There is no middleman when trading with an ECN broker

- ECN brokers link various liquidity providers, including banks, institutional traders, and retail traders

- The market is more fluid

- ECN offers faster execution

- ECN accounts offer much tighter spreads

- In some cases, ECN brokers offer instant trade executions

- In some cases, you are able to trade through news events and special situations if you have an ECN account.

Disadvantages

- Transaction costs can be high in terms of commission

- Might not be able to trade all assets a broker has available

- Typically requires a large minimum deposits

- Typically requires a large trading account balance

Bottom Line

If you are looking for a good “all-around” broker that offers a great ECN account for all regions, along with tight spreads and minimal fees, then without a doubt, ZFX is your best bet. ZFX has shown that not only do they listen to their clients and provide the services and features that they need, but they provide the best.

All aspects of ZFX, from their ECN accounts to customer support, the registration process, who regulates them, to how you can deposit and withdraw funds, are excellent. We did not even include the special promotional offers, the upcoming Interest Program, and the LMS (trading academy) they are implanting. ZFX is truly the best ECN and STP broker in Malaysia at this point in time.

FAQs

Which broker has ECN?

ZFX has ECN accounts and is a No Dealing Desk (NDD) broker. They connect clients to banks, interbank markets, and liquidity providers. ZFX further subdivides NDD into Straight Through Processing (STP) and Electronic Communication Networks (ECN) accounts, depending on the many varied needs of the client.

Which ECN broker is best in Malaysia?

ZFX is the best ECN broker in Malaysia. They are regulated by the FCA and FSA, have been in operation since 2016, and hold numerous brokerage awards for their services and features.

What is the minimum deposit for an ECN broker?

The minimum deposit for an ECN broker will vary dramatically. In the case of ZFX, the minimum amount is 1,000 USD, but they are reputable and a safe bet. Other brokers, such as AximTrade, only have a 50 USD minimum for their ECN accounts, but they are not as reputable.

Is ECN safe?

ECN brokers are safer as they allow you to trade with no conflicts of interest along with transparency. Also, brokers such as ZFX further subdivide NDD into Straight Through Processing (STP) and Electronic Communication Networks (ECN) accounts, making for faster and safer trade executions.

Is ECN good for scalping?

ECN is great for scalping due to the fact that ECN accounts mean there is no “middleman.”. This essentially means that trades are executed lightning-fast, and in some cases, many brokers offer ECN accounts with instant trade executions.

Which broker is best, ECN or STP?

ECN and STP are different, and one may not necessarily be better than the other. It will depend on the trading situation. ECN brokers only route orders to the interbank market, whereas STP brokers can route orders to any of their liquidity providers, such as banks or interbank exchanges. Some brokers, such as ZFX, are STP and ECN brokers.