In this article, we compare the best forex brokers in Malaysia. We outline and go over the various services and features that a broker should have to satisfy needs that individuals new to trading have and can add value to professional traders alike.

We cover everything for each broker, from being regulated to trading accounts, what assets they offer to what makes these brokers stand out from the rest. Let’s see who the top forex brokers in Malaysia 2023.

Top 15 Forex Broker Malaysia

Finding the best forex broker in Malaysia should not be a struggle if you know what features and services you are looking for and which of these a top forex broker should have. If you are new to trading and don’t really know what to look for, then don’t worry because we are here to help.

We’ll cover some of the major elements you should look out for, and the first is knowing whether a broker is regulated and reliable. After that, you will need to consider aspects like if a broker is “beginner friendly” and do they have trading resources like educational material and up-to-date market news and analysis (all things which could help you learn and progress as a new trader).

If these checkboxes are ticked, you will need to consider what assets (financial instruments) they offer and what account types are available. This means knowing your appetite for risk, i.e., some brokers have demo and Cent accounts allowing you to get a feel for trading, while other accounts may offer tight spreads but will need a large minimum deposit.

These are the cornerstone elements you will need to look over to find a broker that suits you and your situation, and luckily, we have done all the heavy lifting for you. These are the top licensed forex brokers in Malaysia 2023.

- ZFX

- XM

- IG

- Capital.com

- eToro

- FP Markets

- RoboForex

- Axi

- Markets.com

- CMC Markets

- Exness

- FBS

- TriumphFX

- DollarsMarkets

- Bold Prime

Forex Broker Comparison Malaysia

| Broker | Overall Rating | Accepts MY Residents | Official Site | Min Deposit | Max Forex Leverage | Beginner Friendly | Regulators |

| ZFX | 9.2/10 Review | Yes | Account Creation | 50 USD | 2000:1 | Exceptional | FCA, FSA |

| XM | 7.8/10 Review | Yes | Account Creation | 5 USD | 1000:1 | Quite Good | ASIC, CySEC, FSCA, FCA, FSC, IFSC |

| IG | 7.5/10 Review | Yes | Account Creation | 0 USD | 500:1 | Not Bad | ASIC, FCA, JFSA, MAS, FINMA, FMA,CFTC |

| Capital.com | 6.9/10 Review | Yes | Account Creation | 20 USD | 500:1 | Very Good | FCA, ASIC, CySEC, NBRB, FSA |

| eToro | 6.7/10 Review | Yes | Account Creation | Depends On The Payment System | 30:1 | Exceptional | ASIC, CySEC, FSA, FCA |

| FP Markets | 6.6/10 Review | Yes | Account Creation | 100 AUD or Equivalent | 500:1 | Not Bad | ASIC, CySEC, FSCA |

| RoboForex | 6.6/10 Review | Yes | Account Creation | 10 USD | 2000:1 | Fairly Good | FSC |

| Axi | 6.6/10 Review | Yes | Account Creation | 0 USD | 500:1 | Not Bad | ASIC, FCA, DFSA |

| Markets.com | 5.9/10 Review | Yes | Account Creation | 100 USD | 300:1 | Ok | ASIC, FSCA, FCA, CySEC, FSC |

| CMC Markets | 6.5/10 Review | Yes | Account Creation | 0 USD | 30:1 | Not Bad | ASIC, FCA, FMA, BaFin |

| Exness | 7.5/10 Review | Yes | Account Creation | Depends On the Payment System | Unlimited | Quite Good | CySEC, FSA, FSCA, FCA, FSC, CBCS |

| FBS | 7/10 Review | Yes | Account Creation | 1 USD | 3000:1 | Quite Good | ASIC, CySEC, FSCA, IFSC |

| TriumphFX | 2.4/10 Review | Yes | Account Creation | 100 USD | 500:1 | Poor | FSA |

| DollarsMarkets | 3.6/10 Review | Yes | Account Creation | 15 USD | Unknown | Poor | FSC |

| Bold Prime | 3.5/10 Review | Yes | Account Creation | 15 USD | 2000:1 | Ok | ASIC, FSC |

Best Forex Trading Platform in Malaysia (Reviewed)

1. ZFX

ZFX is our number one pick for the top forex broker in Malaysia. Founded in 2016 and part of the Zeal group, they aimed to establish an online trading platform that would be considered one of the best and most accessible platforms that investors, retail traders, and institutions could utilize.

Even though they can be seen as still a relatively new broker, ZFX offers features and services that overall surpass other brokers when not looking only at the forex trading in Malaysia but also on a global scale.

Licensed and regulated by the FCA and FSA and holding numerous awards, including “The Best Fintech Platform,” ZFX has gained a foothold in the online trading space. This comes as no surprise with its outstanding customer support and sterling customer reviews that convey their satisfied opinions on the wide array of tradable assets in the form of CFDs, including forex, commodities, stocks, indices, Bullion, and Crypto.

This low-spread forex broker offers zero commission, zero fees, and high leverage to give you the best options for your trading goals.

Their trading accounts are separated by region and are suited for all traders, including beginners and advanced market specialists. Using the gold standard that is MetaTrader 4, which is available for Windows, Mac, and Android, not to mention their proprietary mobile app (that lets you trade anytime, anywhere, and anything), ZFX gives you a great overview of the trading world if you are a beginner and the tools you need to make the most out of your trading if you are a professional.

Other impressive services and features that ZFX provides include their A-Z Academy, market outlook and analysis, and trading competitions. They are even implementing an LMS trading course where users can register and work through trading educational modules improving and honing their trading skills.

Not only does this broker have some nice all-around features and services, but account registration, depositing, withdrawing funds, and trading are a breeze. If you are looking for a broker or even thinking about changing brokers, then we recommend you take a look at them first.

Pros

- Three to Two types of trading accounts depending on the region

- NDD, STP, and ECN broker

- Regulated by the FCA and the FSA

- Great resources for traders (A – Z Trading Academy)

- Low initial deposit ($50) with a minimum lot size of 0.1

- 100+ assets to trade

- Tighter spreads on ECN accounts (from 0.2 pips)

- Zero commission with low spreads

- Spreads As Low As 0.2

- $15 Minimum Deposit (Cent Account)

Cons

- $1,000 deposit for traders on ECN Accounts

- Trading is not available to U.S.-based residents

- No Web-Based Platform

2. XM

XM is our second pick for the best broker in Malaysia. They have some of the best trading resources you can find from a broker, but you might get a bit overwhelmed if you are new to forex and trading. From trading ideas to a market overview, XM tries to cover all the basics, and they do so relatively well.

Offering a large asset list that also comprises of being able to purchase actual shares and not just trade them as CFDs, XM is a good broker for traders that have prior knowledge of the markets and are somewhat experienced in trading.

They offer similar account types to ZFX, but they have more, making it a bit more complicated to decide which account will better suit your situation (unless you know what you need).

Their customer support is also quite reputable, with them having achieved some awards. In terms of trading platforms, XM offers both MetaTrader 4 and MT5 (used for share positions) and their own proprietary mobile app.

XM has been around since 2009, and being regulated by various authorities has built them quite a popular reputation over the years. They also offer some nice promotional deals from time to time, like a signup bonus and their loyalty program.

Pros

- Regulated by 6 authorities

- No deposit or withdrawal fees

- Deposit bonus

- Referral program

- Loyalty program

- Over 1,000 instruments to trade

- Great educational material

- 24/7 customer support

Cons

- Limited to specific regions

- Standard account spreads are quite expensive

- Average spreads are not published for ultra-low accounts

- Average forex portfolio

- No investor protection for residents outside the EU

3. IG

IG is one of the oldest brokers we are reviewing, as they were established all the way back in 1974. Offering over 19,000 instruments to trade through CFDs, share trading, and spread betting, this broker has one of the largest asset lists we have come across. Not only is this broker well trusted and has been for decades, but they are also listed on the UK Stock exchange and makeup part of the FTSE 250.

Clients trust this broker as they trust ZFX, as they are regulated by several authorities, including ASIC, JFSA, MAS, FINMA, FCA, FMA, and the CFTC.

Clients can expect to use the “all trusted” MetaTrader 4 and proprietary software with this broker, all on a single account type. However, trading conditions, fees, and available markets may vary depending on the trading platform you choose or the options you subscribe to when you open your account.

IG takes the education of its clients seriously. The broker offers various interactive educational tools and numerous online courses in the IG Academy. From the basics of how the markets work to the most advanced technical and fundamental analysis, traders will find everything they need to advance their knowledge and improve their trading.

This broker is great if you have experience in the markets and are looking to trade very obscure assets.

Pros

- Education and research focus

- Offers protection for U.K./E.U. client account

- Well-reputed global presence

- Wide range of products offered

cons

- No guaranteed stop losses for US clients

- No copy trading or back-testing integration on the IG platform

- High share-CFD fees

- No account protection for US clients

4. Capital.com

Offering over 3,700 assets that consist of forex, stocks, commodities, indices, and crypto, this award-winning broker was founded in 2016. Unlike ZFX, which uses MetaTrader, Capital.com are trying to go the modern route by basing its platform on TradingView. TradingView is a platform that is fast entering the top spot among the best platforms to use but still does not offer all the features the MT4 or 5 does.

Remember that most traders (especially experienced ones) have been using MetaTrader since the early 2000s, so this broker is not likely to pick up those traders as clients. This is one downfall of using new software.

On the positive side, what really makes this broker shine is its reputation. It is regulated by several financial authorities, including the FCA, ASIC, CySEC, NBRB, and FSA. In terms of trading resources and education, this broker does not fall short of the top performers on this list. You can expect to find market news, analysis, webinars, and an economic calendar. As with ZFX, this broker is detailed in their approach to teaching new traders how to trade while offering experienced traders new insight.

Also, expect reliable customer support through telephone, live chat, social apps, Email, and a FAQ section. The broker offers three account types, with each having an increased minimum deposit. Everything else from this broker is what you would expect from one that sits quite high on our list.

If you are looking for a good broker with a good set of stocks to trade as CFDs, then this broker just might be your ally.

Pros

- No withdrawal, deposit, or inactivity fees

- Fast order execution

- Non-expiring Free demo account

- Hedging mode and risk management tools

- Regular live updates and price alerts for 3,700+ markets

- 0% commission and no hidden fees

- Market-leading spreads

Cons

- No bonds offered

- Doesn’t offer MetaTrader5 (MT5)

- Overnight fees

- Stock trading is not currently available on their web terminal

- Limited offering of stocks

5. eToro

eToro is one of the most popular brokers on our list. They were founded in 2006, and its headquarters are in Tel Aviv, Israel. The platform has snowballed in recent years. They have grown so large that they now boast more than 11 million registered users in over 140 countries. They are also fully regulated by top-tier financial authorities, including the FCA in the UK and the CySEC in Cyprus.

You can expect to trade CFDs in forex, stocks crypto, commodities, indices, and ETFs with eToro and clients will do so on a proprietary web terminal and through the eToro mobile app. As with Capital.com the web terminal is very beginner friendly but lacks the tools to do in-depth technical analysis.

One aspect of this broker is that their only form of support is a “ticket submission” channel. Most brokers at such a “high” level typically have multiple forms of support for customer convenience. However, eToro does not, which might be due to their sheer number of clients. This is our assumption, anyway.

eToro has a comprehensive blog for news and analysis as well as their Academy, which covers all aspects of trading in video and text format. The great thing about it is that anyone can visit their site and browse the catalog of educational content.

This broker would be higher on the list, but they just fall short due to limited support and payment options. Also, they don’t offer any special promotions; However, the platform is based on copy trading, which means you can copy traders and their strategies at the click of a button.

Pros

- Adjustable leverage per trade

- One account to suit everyone (great for beginners)

- Great trading resources

- Trendy platform

- Have over 11 million users

- Easy-to-use platforms

- Very beginner friendly

- Able to trade CFDs

Cons

- Spreads are not great

- Only one account, so you don’t have flexibility

- Customer support is only through tickets

- You can only trade CFDs

6. FP Markets

FP Markets make the cut on our list because of the simplicity of their services and features, which are not understated but rather exude quality. This broker was founded in 2005, meaning they have operated since 2005. ASIC, CySEC, and the FSCA also regulate them. Thus, this broker has gained a name for itself over the years for safety and reliability.

Clients can expect to trade forex, stocks, indices, commodities, bonds, crypto, and ETFs on MetaTrader 4 and 5 with FP Markets. In terms of trading resources, clients can expect everything from eBooks to Podcasts, Webinars, Video Tutorials, and more.

They offer negative balance protection across their two account types, and there are many methods for depositing and withdrawing. These include bank transfers, e-wallets, crypto, and social apps.

Although this broker seems to tick all the checkboxes, they do not really excel at any aspect of their services, features, and what they offer their clients. Otherwise, they would have ranked higher.

Pros

- Over 10,000 assets to trade

- Good amount of trading resources

- Islamic Swap Free accounts are an option

- Many funding methods are available

- MT4 and MT5 are available

- Been in business since 2005

- Regulated by multiple financial authorities

- Two easy-to-understand account types

Cons

- Some information and trading resources on the site are outdated

- There is no Cent account available

- There are no special offers except for the affiliate and IB program

- Only trade CFDs

- There is a minimum deposit of 100 AUD or the equivalent

7. RoboForex

RoboForex is a large broker with over 1 million clients located in 169 countries across the globe. They might seem like a great broker, and for the most part, they are, but they are lacking in certain areas. The first is that only one broker regulates them. This is not to say that they are unsafe, but a broker at this level should consider getting multiple regulations from authorities that oversee specific regions. This builds a better overall reputation and is one that traders are always looking for.

Then in terms of trading resources and educational materials, this broker is at the lower end. That is to say that they do not have enough. You will only find a blog, forex analysis, and trading tips sections. However, the information provided is what you could call the “bare minimum.”. There is nothing that potential new traders can learn and latch on to.

Some positives about this broker are their payment gateways which there are many and their customer support. This broker offers support channels in the form of a Contact Form, Telephone, WhatsApp, Facebook Messenger, Live Chat, Telegram, and Call Backs. This is more than most brokers, which seems to suggest that they have their client’s best interests at heart.

Expect to trade forex, crypto, stocks, indices, commodities, and ETFs in the form of CFDs and share through MT4, MT5, and proprietary software with RoboForex (another plus).

Pros

- More than 12,000 instruments to trade

- Lack of trading resources and education

- Have a few promotions and special offers

- In operation for over a decade now

- Accumulated over 30 industry awards

- Can trade CFDs for forex, stocks, crypto, commodities, and indices

- Can also trade in shares

- Cent account is available

- No deposit or withdrawal fees

- MetaTrader (4 and 5) are available

- They have proprietary trading software

- There are 5 trading account types

- Low spreads on some accounts

Cons

- Only regulated by the FSC

- Not many trading resources or education

- Low customer trust rating

8. Axi

Axi is another online forex CFD broker that has been around for some time (2007, to be precise). The history of this broker is quite a story, as it was a two-person startup that turned into a global corporation. In terms of the features and services that new and professional traders are looking for, Axi offers (for the most part) what they are looking for but falls a bit short in some areas.

Axi is regulated by three authorities and spans more than 100 countries worldwide. Their assets list includes what you would normally expect from a solid broker, like forex, stocks, crypto, commodities, and indices.

Their accounts mimic those of ZFX and XM, except for the fact that they don’t offer a “small” account for beginner traders to test the waters. Standard, Pro, and Elite accounts are all you will find at Axi, and although they do offer some low spreads, you will need to be prepared to pay a commission on your trades on the Pro and Elite accounts.

Once again, we would rate Axi as a broker better suited for traders with more experience because navigating and understanding their website will take some time. Regarding trading platforms, Axi offers MetaTrader 4, a web terminal, and their mobile trading app.

Their customer support is also a cut above the rest, offering customer service channels through live chat, Email, telephone, and even WhatsApp. Then you have their trading resources which are nearly on par with that of XM, but if you are inexperienced and new to the world of trading, you may find their resources to have a steep learning curve.

Although this broker may have a few instances where ZFX and XM outshine them, we still regard Axi as one of the best forex brokers in Malaysia.

Pros

- Very low forex fees

- No withdrawal or deposit fees

- Creating an account is fully digital

- Regulated by three authorities

- Deposit insurance and compensation plans are available

- A typical range of tradable instruments on offer

Cons

- Demo account is only available for 30 days

- Users have experienced problems withdrawing funds

- The account verification is complicated and drawn out

9. Markets.com

Listed on the FTSE 250 due to them being owned by the Finalto Group (which is a division of Playtech), Markets.com is the next broker to make our forex broker list. Markets.com is a bit different compared to the rest of the best forex brokers in Malaysia in that they offer different tradable financial assets in the way of Blends, ETFs, and Bonds, along with the typical forex, commodities, stocks, and indices.

Blends and ETFs are nice “baskets” to trade if you are a beginner, but the reality is you should know what the underlying instruments of these assets are tracking to make better trades. With that being said, we also consider Markets.com to be more suited toward traders with more experience.

They do have “stock” accounts that clients can open similar to the ones we have mentioned from other brokers, but a commission may apply depending on the asset you wish to trade. They also have a higher minimum deposit fee that sits at the 100 USD mark for all accounts.

Signing up to Markets.com will give you access to their licensed version of MT4 and MT5, along with their own take on a web terminal platform. New traders will need to overcome this learning curve if they don’t like MetaTrader otherwise their mobile trading app is the only other option.

Their customer support is on par with our other forex brokers, offering live chat (which is a great service for any broker), telephonic, and Email support. In the way of trading resources, Markets.com offers a news feed from Reuters along with some news and market analysis. These resources, when compared to the other best brokers in Malaysia, seem somewhat lackluster.

Pros

- Regulated by 5 financial authorities across the globe

- Their assets list is among some of the largest for any broker

- Impressive proprietary trading platforms

- Fast execution of positions

- Mobile trading app and web platform are seamless

- Free Reuters reports

Cons

- High forex spreads compared to other brokers

- Low leverage compare to some other brokers

- Account inactivity charges

10. CMC Markets

Next up is CMC markets, a UK-based online forex broker listed on the FTSE 250 along with Markets.com. This is probably the oldest broker on our list, being founded all the way back in 1989 by Peter Cruddas.

Similar to that of Markets.com, once again, they also offer assets like Bonds and Share Baskets, but nothing in the way of ETFs. You will also be able to trade forex, commodities, indices, and crypto in the form of CFDs with this broker.

One of the reasons this broker comes in with a “mid” score is the fact that they also require traders to go through a steep learning curve if they want to trade using their Next Generation Web Platform. They offer MT4, but this broker pushes their proprietary software and doesn’t offer much in the way of resources when trying to learn it.

Then there are their customer support channels that only include Email and telephonic support along with a FAQ section (something all our top forex brokers have regardless of other features). Their account types can also be confusing as they offer a spread betting account to UK residents only, a CFD account, and an FX-only account. If you are not well-versed in trading and do not take the time to comb through the account types information, you will surely get confused.

Pros

- Low forex fee

- No minimum deposit

- A Spread betting account that is tax-free

- Outstanding proprietary platform

- Advanced educational and resource material to draw on

- Regulated by the FCA in the UK

- Offers protection for trader accounts

Cons

- High stock CFD fees

- Only CFDs are an option

- Customer support is only 24/5

- Only offer MT4 and not MT5

- Does not accept US Clients

11. Exness

Exness has been in operation since 2008, is based in Limassol (Cyprus), and is managed by Nymstar. We give this broker quite a high ranking and put it in a relatively similar category to that of XM due to some great features and services that they offer their clients.

Besides being regulated by multiple authorities, this broker has a wide array of trading resources and education that almost rivals that of XM. Moreover, they also offer clients many trading platforms, including MetaTrader (4 and 5), a web terminal, MetaTrader mobile, and their own web terminal and mobile app.

However, they fall short when it comes to the number of available customer channels, which only consist of Email and telephonic support. Then they also drop a few points due to their limited assets list, which does offer the typical instruments (forex, stock, commodities, indices, and crypto); however, there are not that many, and you will only find the most popular securities (not that this is a bad thing).

When considering the trading account types that Exness offer, beginner traders may also feel a bit muddled as the accounts can be a bit confusing, offering 5 in total, some with no or low commissions, raw floating spread, unlimited leverage, and not to mention a 500 USD minimum for some of them.

Exness is good for forex trading in Malaysia, but you will need to know precisely what you are looking for as this broker caters to a more niche crowd, not the masses.

Pros

- Free VPS hosting

- Instant withdrawal of money 24/7 depending on the method used

- Segregated accounts

- Swap-Free/Islamic Account Provided

- High Maximum Leverage

- Narrow spreads

- Multiple trading platforms: MT4, MT5, MultiTerminal, mobile platform

Cons

- 24/7 customer support only available in some languages

- Training resources are minimal

- No US residents can be accepted as clients

12. FBS

We would classify FBS as an above-average broker and almost on par with that of Exness and XM; however, they just miss the mark of holding a top spot due to some features and services that could perhaps be improved upon.

They have numerous broker awards and are regulated by several top-tier authorities, but they fall short when it comes to the number of tradable assets. Yes, they offer forex, stocks, etc, but a broker founded in 2009 should have more to offer their clientele.

They do redeem themselves when it comes to trading resources and educational material. This is where they shine the most, offering everything from financial news to forex TV to webinars and video lessons. They also cover most accounts that would suit almost any trader, but we feel that once again, you will need to understand what your trading plan is and have experience in forex in order to understand what the benefits (pros and cons) of their account types are.

Luckily, they have not put time and energy into developing their own unique trading platform like some of the top forex brokers in Malaysia but rather stuck to the tried-and-tested MT4 and MetaTrader 5. They also have a MetaTrader web terminal and their own app, and having gone the MetaTrader route is best because of the time and patience it will take to understand this broker fully.

At this point, we want to reiterate that although these brokers may not have a high score like ZFX, these brokers are still considered quite reputable and well worth the time to look them over if you are looking for a top licensed broker in Malaysia.

Pros

- High leverage up to 1:3000 (for non-EU customers only) suits higher-risk traders well

- Low spreads and commissions (from 0 pips) on most accounts

- Free demo account for every account type helps clients to do a trial

- Free social trading app (FBS CopyTrade) for traders to improve their performance and knowledge by copying other investors (for regions under IFCA and FSCA regulations only)

- Exemplary, multilingual customer service is always available

- No withdrawal fees

- Strong research and education resources

Cons

- It lacks proprietary web and desktop platforms

- Some instruments have wide spreads

- Limited number of commodities to trade

- EU, UK, and Australian clients have fewer account options than clients from other regions

13. TriumphFX

TriumphFX, compared to other top forex brokers in Malaysia, sadly does not make the cut. There are a few things to consider here, however. Firstly is that we reviewed TFXI.com and not TriumphFX Cyprus. Then there were many discrepancies that we could just not account for, plus there was a lot of contradictory information we came across.

Even though the FSA regulates this broker, there are numerous reports along with client reviews calling this broker out and saying that they are, in fact, not that reputable. Through our detailed review, we found that they don’t offer customer support (or at least scouring their website provided no information on customer support whatsoever). We had to navigate to their Facebook page, where an Email address could finally be found.

Then, finding information on the various assets, along with how many they offered, proved to be just as difficult. Navigating to the assets section did not clearly indicate what was available, and we could only say that they offer forex, commodities, and indices.

The only option for a downloadable trading platform was that of MT4 for Windows, even though the broker has information stating it is available for Mac and Android. The only other way to trade is through their web terminal.

In terms of trading resources, we could only find the bare minimum that included an economic calendar, a basic forex article overview, and market analysis (which was not too bad).

In our opinion, they also have too many accounts that total a number of 7 which will definitely be confusing to any new trader. The only thing that kept this broker from getting a lower score was that they offered a somewhat “ok” referral and IB program.

Compared to other brokers in Malaysia, we would not really recommend this broker, but rather, we suggest looking at other options first.

Pros

- 7 different accounts to choose from

Cons

- The asset list is small

- There is no customer support

- Potentially a scam

14. DollarsMarkets

DollarsMarkets is another broker that we found to be lacking in many areas. Although the FSC regulates them, another review site ForexBrokerz found that the SCM blacklists them. This does not also take into account the numerous bad reviews from clients on sites such as TrustPilot, where the broker is called out for “illegal forex trading” in Malaysia.

However, some reviews from clients are adamant that this broker is legitimate. In terms of available assets to trade, you are looking at forex, stocks, commodities, indices, and metals, but the site does not give additional information on this. It is only when we go over their two account options that we see that they offer a number of assets that also include crypto, energy, and ETFs.

The only downloadable trading software platforms on which we could get our hands were MT4 and MT5 for Windows, despite links to Android and Mac versions (these links returned errors).

The one aspect that raised the overall score of this broker was that they offer online live chat directly accessible from their website. Even so, the only other customer support which is an option is that of Email, but we could not find a timeframe for when support was able to respond.

Another factor to consider is that this broker does not offer negative balance protection (something all the top forex brokers on our list offer). The only redeemable quality this broker has is that they offer a signup bonus, but we can, in fact, not determine if this is really the case.

As with TriumpFX, we recommend looking at one of our other best forex brokers in Malaysia before you opt to give this broker your hard-earned money.

Pros

- Straightforward accounts

Cons

- Poor trading resources

- Contradictory information

- MetaTrader is only for Windows

15. BoldPrime

Bold Prime is a broker that has been in operation for about 2 to 5 years, and they are somewhat reputable, but their age (in terms of how long they have been in business) can still be seen in some of the features and services that they offer.

On the upside, Bold Prime offers similar accounts to our top brokers, including Cent, Standard, and Platinum accounts. Then they offer a few special promotions, including an IB and loyalty program and a welcome bonus. However, this is as far as it goes with this broker.

In terms of tradable assets, there is a ton of contradictory information on their site stating that they offer over 27 currency pairs but checking their account types; they state that they have over 350 and 400 available depending on the account you wish to open.

Then they offer MetaTrader 4 and MT5 along with a web terminal that is only accessible from the client area. The factor to consider here is that (just like TriumphFX and DollarsMarkets) there is no option to download MetaTrader for Mac or Android, even though this is stated on their website.

On top of this, they also offer no negative balance protection, offering clients no safety against losing trades. In fact, their client agreement states that they have the right to deduct funds from any other account if you lose a trade and go into the negative.

Lastly, we could only conclude that they offer deposits and withdrawals only through internet banking. This is unlike the other forex brokers on this list that offer multiple ways, including e-wallets, credit and debit cards, and more.

Once again, we suggest that the brokers that score under 5 for our best forex brokers in Malaysia should be given a pass, and you are better off looking at brokers that make the cut, like ZFX.

Pros

- Cent account

- Minimum deposit of only 15 USD for Cent and Standard account

- High leverage

- Regulated by ASIC and the FSC

Cons

- No negative balance protection

- Contradictory information on the website

- Only internet bank transfers allowed

- No telephonic support

- Small assets list

- Relatively new broker

- No help desk or FAQ section

- Limited resources that only clients can access

How To Start Forex Trading in Malaysia?

Now that you have looked over our pick of the top forex brokers in Malaysia, you could be considering opening an account with one of them. For the most part, all the brokers that we reviewed have a similar registration method that you will go through online and through their website (or mobile app, if you choose that route).

We will now take a look at how to start forex trading in Malaysia by registering and opening a trading account using our top licensed forex broker: ZFX.

Open a Forex Trading Account

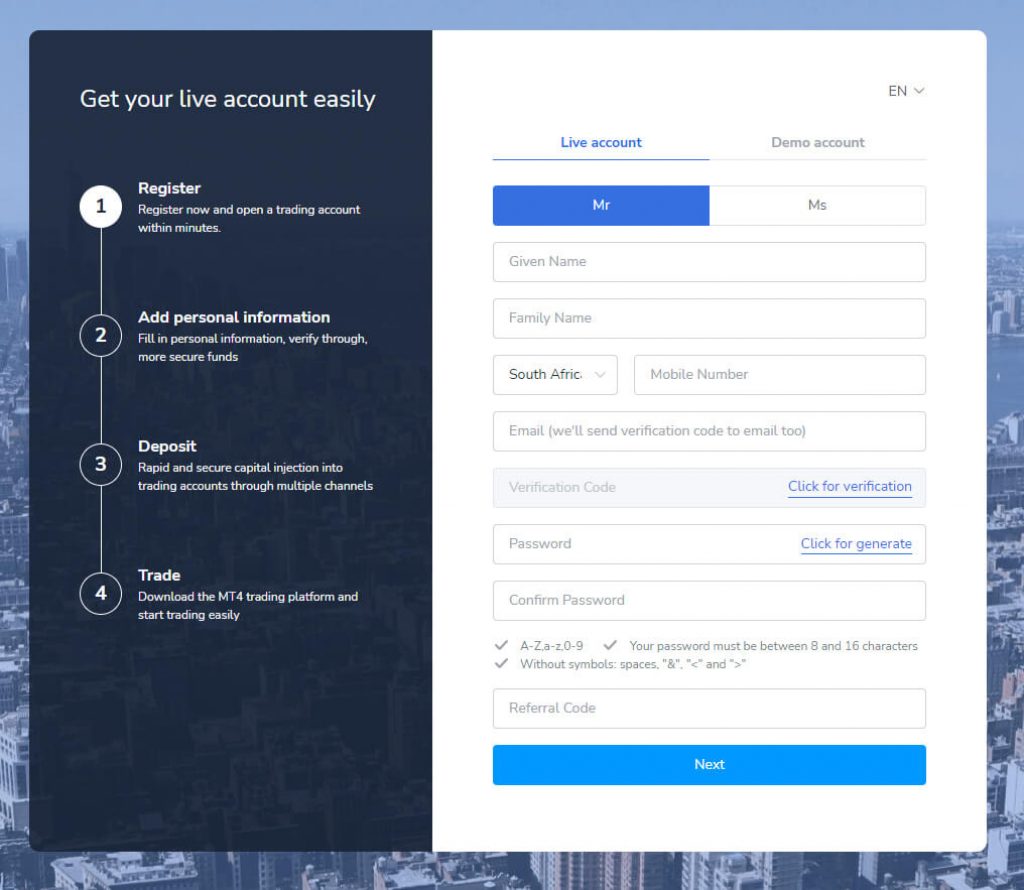

The first thing you will need to do is to head to the ZFX website. Depending on your location, you will automatically be routed to your region’s correct domain. If you are worried that your region’s registration process will differ, you don’t have to. ZFX has consolidated the signup process for all regions, so the interface will be the same for all.

The only difference is that depending on your region, you will be prompted with the appropriate account types when asked to choose.

Once you have headed to the ZFX website, you must click on the “open an account” button at the top.

You will then be taken to the registration page, where you will need to fill out some personal information that includes your title, name, last name, country, phone number, and password. It would help to remember that you can choose to open a live or demo account from this screen.

After ZFX has sent the verification code to your phone and you have input it into the appropriate field, you will be able to proceed to the next page.

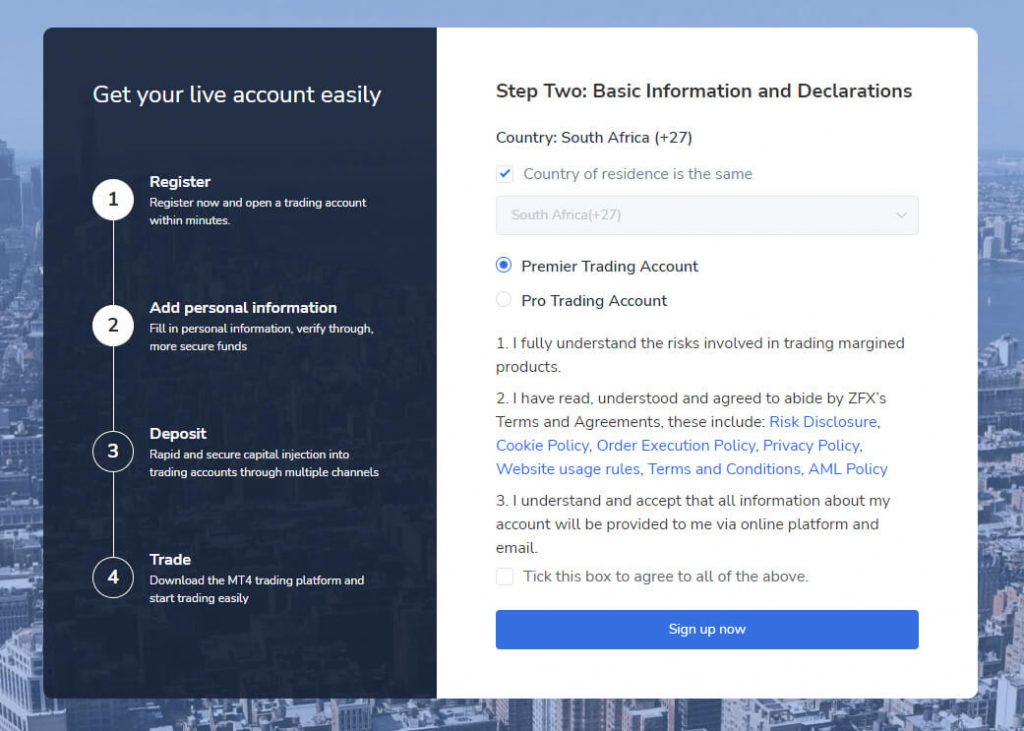

This is where you will choose your account type. Remember that the account types here will be different depending on your region. We happen to be signing up in the MENA region, so our account options are the Pro and Premier accounts. If you are signing up from Malaysia, your account options will include the Mini, Standard STP, and ECN accounts.

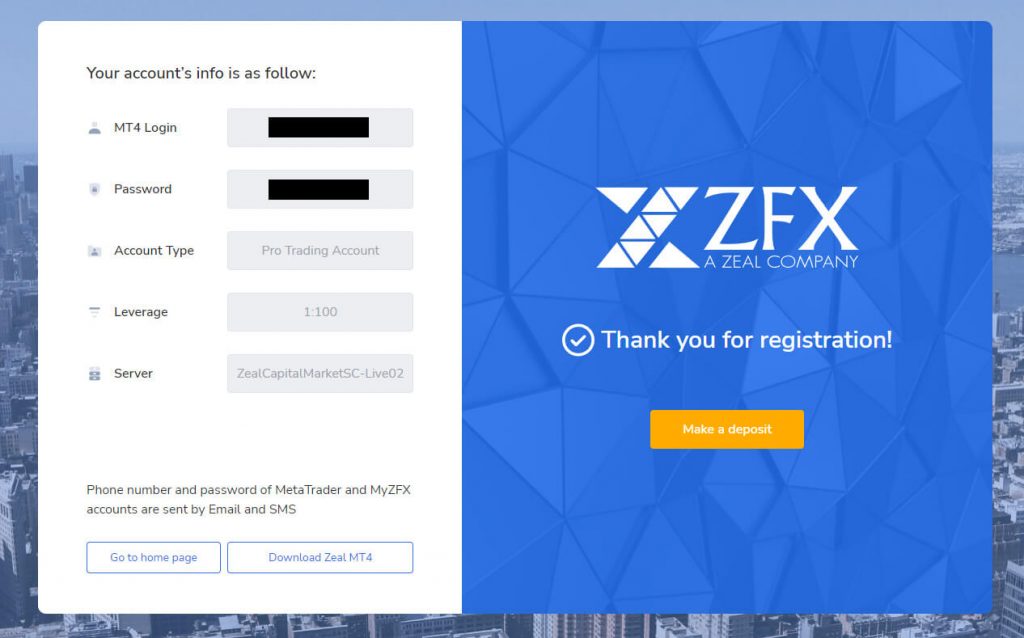

Following that, you will be prompted with a screen that gives your account details with the option to download MT4. You should, at this point, save your account information because you will need it to log in to MT4, while the account password that you chose will be used to log into MyZFX (the client backend).

Make your First Deposit

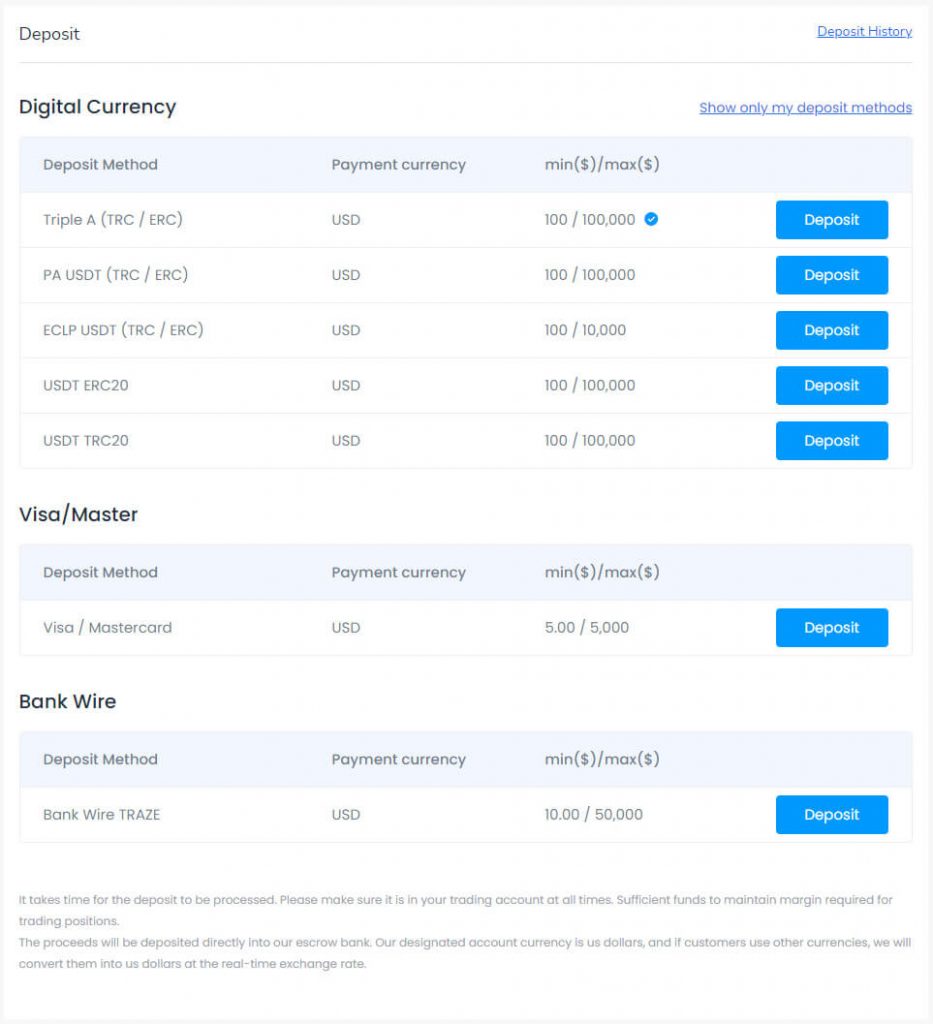

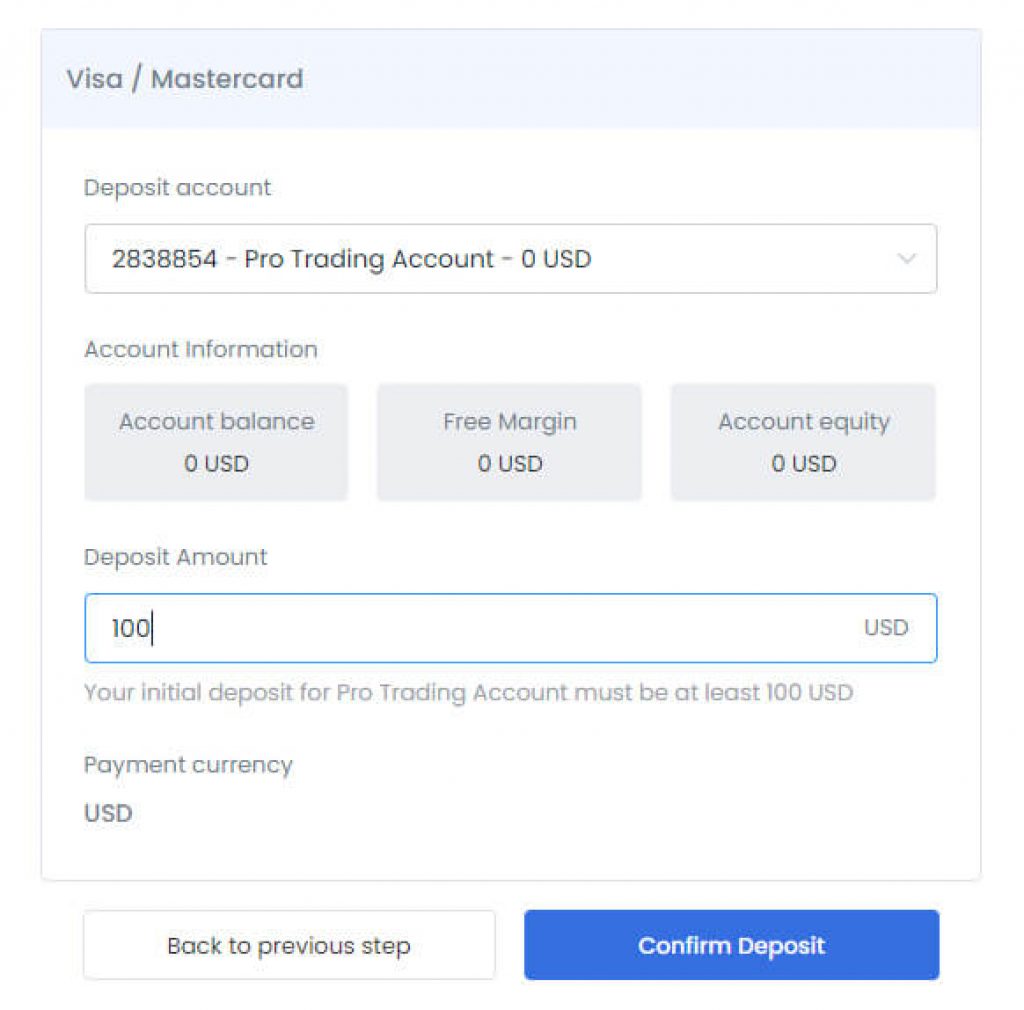

If you choose to open a live account, you will need to deposit (which you can see in the image above). Clicking on the “make a deposit” button will take you to your personal client area, where you will have many methods by which you can deposit funds into your account.

Then depending on the method you choose, there will be a minimum deposit that you will have to adhere to. At this point, you will need to fill out the necessary details, click “confirm” deposit, and you will be taken to a secure payment portal where you can complete your deposit.

Start Trading

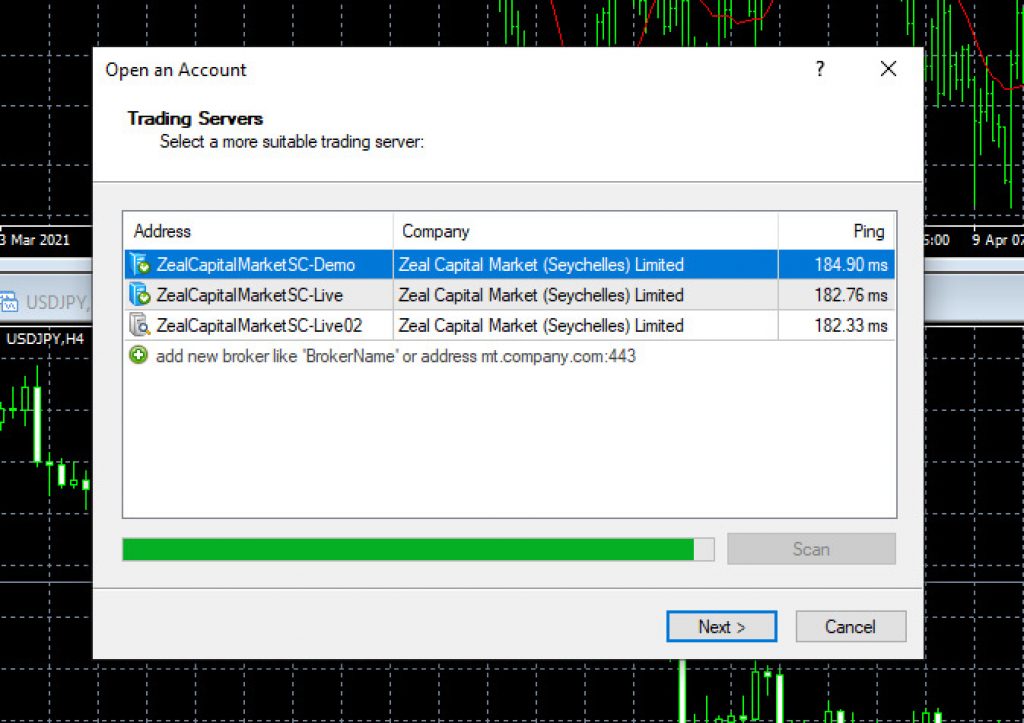

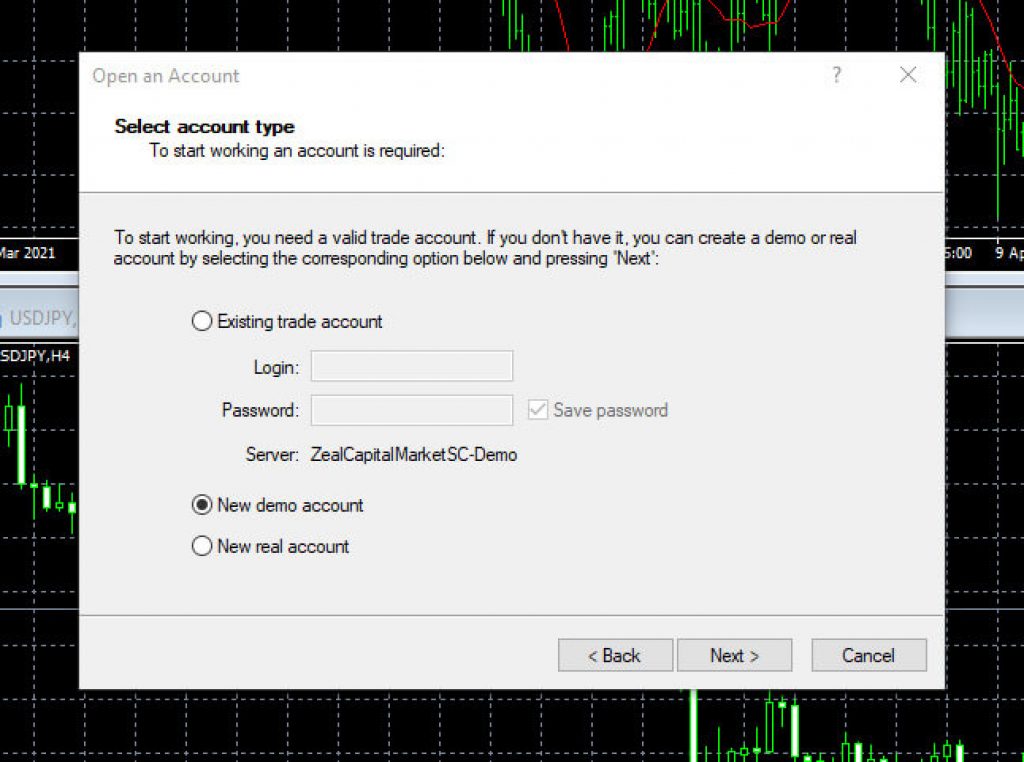

To start trading, you would have needed to download MT4 when you were prompted to during the signup process. Once you have installed it on your local machine, you will have to open it up and select which ZFX server is applicable.

After that, you will be prompted to choose your existing account, which is either a demo or live account (depending on which you chose to open up with ZFX). Input the required fields, and you are good to go. MetaTrader will load, and you will be able to view the asset charts and place trades.

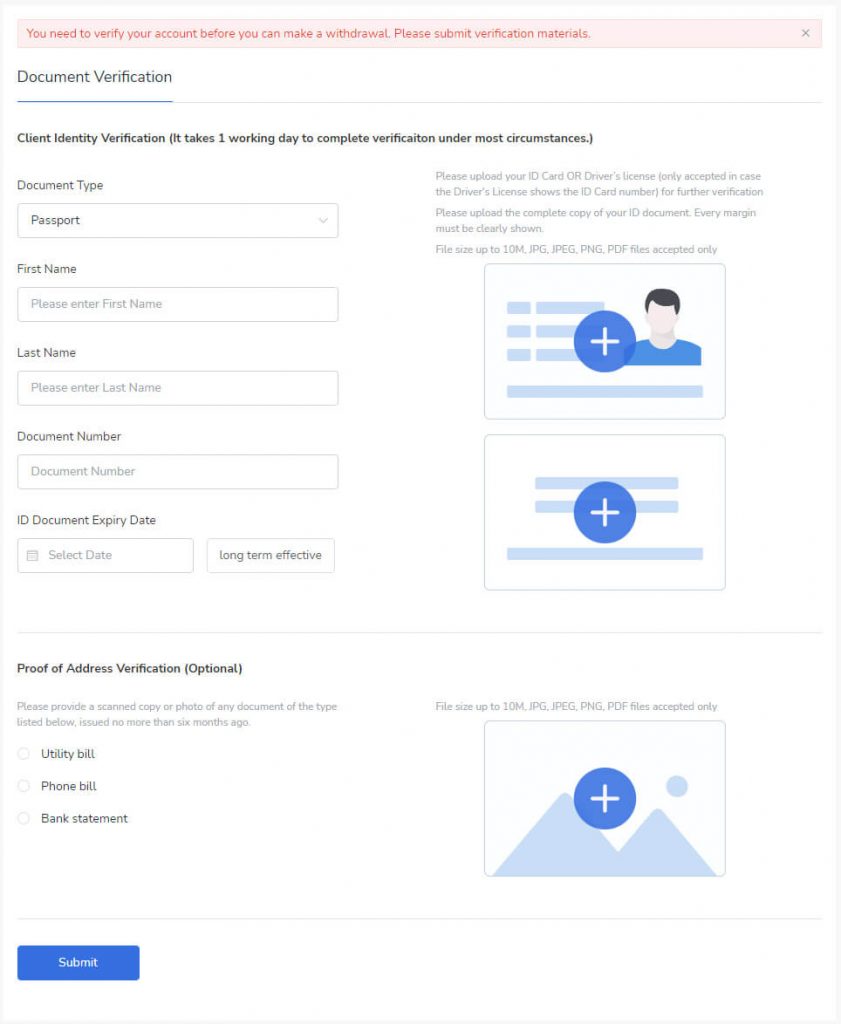

Take note that if you plan on making any withdrawals from your account, you will first need to go through the verification process that you will find in your MyZFX client area. This will include uploading the required documents, as shown in the image below.

Advantages and Risks of Forex Trading in Malaysia?

Advantages

- Low cost to start trading

- Some brokers have low spreads

- Some brokers have low or even no commission fees

- Demo and small live accounts to get you started

- Able to have varying trading styles

- Forex has high liquidity

- There is no regulator or central exchange

- Brokers in Malaysia offer many forex pairs to trade

- The barrier to entry in terms of learning is low

- Leverage can be beneficial

- Less potential for insider trading

- Able to short sell thanks to CFDs

- Can base trades on technical strategies

- Tax rules are easy to understand

Risks

- The forex market is volatile

- High-risk, high leverage

- The forex market can be tough for some to grasp

- The price determination is somewhat complex to understand

- Choosing a safe broker can be tricky

- Trading is risky

- Small traders sometimes face a disadvantage

- There are fewer residual returns

Bottom Line

Our forex broker list comprises what we think are the best forex brokers in Malaysia. ZFX seems to be your best bet if you are a new trader looking for a safe and reliable broker that has the assets you are looking to trade using the gold standard in trading software and has useful trading resources and educational material.

FAQs

Which broker is best in Malaysia?

ZFX is the best broker in Malaysia. We did a comprehensive review of all the best forex brokers in Malaysia and concluded that ZFX overall has the best features and services for any new trader and also for professionals.

Which forex is legal in Malaysia?

As of February 2012, the Bank Negara Malaysia classified the buying and selling (trading) of forex (foreign currency) allowed in Malaysia. However, you will need to know that you are only allowed to trade with investment banks, Islamic banks (both local and international), and licensed commercial banks.

Which forex broker is SCM regulated in Malaysia?

The brokers which are regulated in Malaysia by the SCM include IG, Interactive Brokers, FOREX.com, XM Group, and AvaTrade. Remember that the SCM (Securities Commission of Malaysia) supervisors exchanges and central depositories. They also regulate all aspects of securities and futures including the approval of corporate bond issues.

Where to trade forex in Malaysia?

You can trade forex from several online brokers that are allowed to operate in Malaysia by registering a trading account with them. You will then need to use their stipulated trading software to trade. This software may be MetaTrader 4 or 5, a mobile trading app, or proprietary software.

What is the best time to trade forex in Malaysia?

The best time to trade forex in Malaysia is when the Ney York, London, or Asia Markets open. Typically, the most volume that is traded is during these times of the day. If you are in Malaysia, then you will look to see when the Malaysian Stock Market opens. This is at 9:00 am MY time.

What is the best forex trading app in Malaysia?

The best mobile trading app in Malaysia is from the broker ZFX. Their mobile trading app is available on Android and iOS. It has a ton of great features that include Market Insight and Market Overviews. It also lets you trade your way by setting your trading conditions (number of lots, stop loss, take profit), and letting you manage your portfolio from the dedicated section.

Does the Bank Negara Malaysia (BNM) regulate forex?

Yes, the Bank of Negara Malaysia does regulate forex. They made it compulsory so that trading forex could only be done through investment banks, Islamic banks (both local and international), and licensed commercial banks.

Is forex trading taxable in Malaysia?

Yes, forex trading is taxable in Malaysia but only as income tax. Forex capital gains are exempt from tax. This means that if you have a swap-free Islamic account and the capital generated from it is not part of your income, it is considered tax-free.